Unlocking Efficiency: How Accounting Software Transforms Your Business

In today's fast-paced business environment, efficiency is more crucial than ever. With the growing complexity of financial management, many businesses are turning to accounting software to streamline their operations. This powerful tool not only simplifies bookkeeping but also enhances overall productivity, allowing companies to focus on their core activities. As we delve deeper into the benefits of accounting software for business, it becomes clear how it can transform financial practices and decision-making processes.

One of the primary advantages of implementing accounting software is the significant time savings it offers. Traditional accounting methods often involve tedious manual entries and cumbersome processes that can lead to errors. By automating these tasks, businesses can reduce the risk of mistakes and free up valuable time for employees to engage in more strategic activities. Additionally, with real-time data access and accurate reporting, companies can make informed decisions quickly, positioning themselves for growth and success in a competitive landscape.

Benefits of Accounting Software

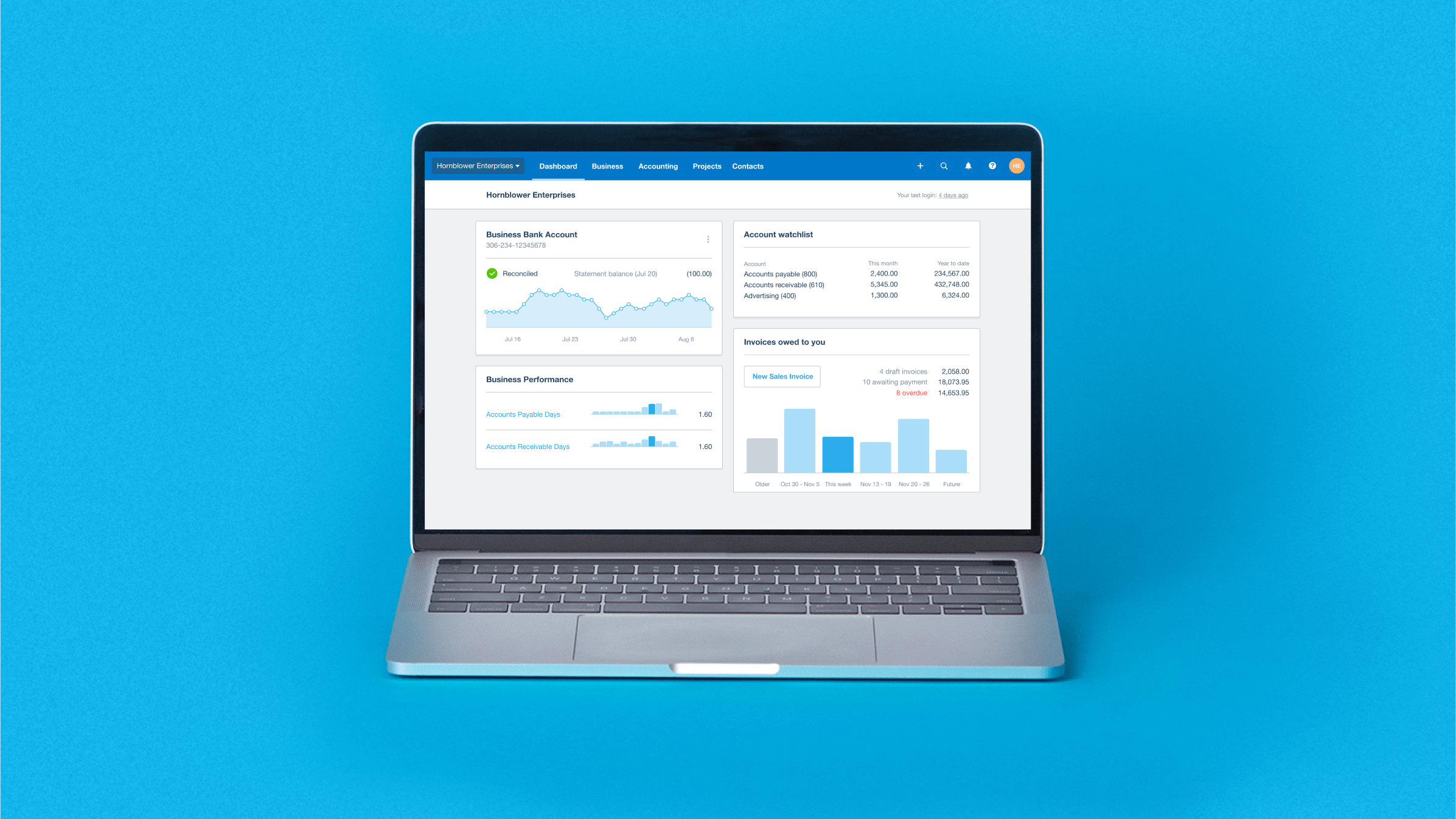

One of the primary benefits of accounting software for business is the significant time savings it offers. Traditional accounting methods often involve tedious manual processes, which can lead to inefficiencies and increased chances of error. With accounting software, tasks like invoicing, expense tracking, and financial reporting can be automated, allowing teams to focus on more strategic activities that drive growth and innovation. The ease of use and intuitive interfaces enable users to navigate the software quickly, resulting in enhanced productivity across the organization.

Another advantage is the improved accuracy and reliability that accounting software provides. Automated calculations reduce the risk of human error, ensuring that financial data is precise and up-to-date. This level of accuracy is crucial for making informed business decisions and maintaining compliance with financial regulations. Additionally, many software solutions offer real-time reporting and analytics, empowering businesses to gain valuable insights into their financial health and make data-driven decisions.

Cost efficiency is also a significant benefit of utilizing accounting software for business . While there may be an initial investment in acquiring the software, the long-term savings often outweigh the initial costs. By streamlining administrative tasks, reducing errors, and improving financial visibility, businesses can better manage their resources and minimize unnecessary expenses. As a result, accounting software not only enhances financial management but also positively impacts the overall bottom line.

Key Features to Look For

When selecting accounting software for business, it is essential to consider automation capabilities. Automation can significantly reduce the time spent on repetitive tasks such as data entry and invoice generation. Look for software that automates transaction recording, financial reporting, and tax calculations. This not only minimizes human error but also allows your team to focus on strategic planning rather than mundane bookkeeping activities.

Another critical feature is integration with other business tools. The best accounting software for business should seamlessly connect with your existing systems like customer relationship management (CRM) software, payroll systems, and inventory management. This integration helps maintain data consistency across platforms, facilitating better decision-making and enhancing overall operational efficiency.

Lastly, prioritizing user-friendliness is vital. A complex interface can hinder productivity and lead to frustration among employees. Choose accounting software that offers an intuitive design, easy navigation, and robust customer support. This ensures that your team can quickly adapt to the software, fully leverage its capabilities, and ultimately enhance your business's financial management processes.

Choosing the Right Software for Your Business

Selecting the appropriate accounting software for your business is crucial for maximizing efficiency and ensuring that your financial data is managed accurately. Start by assessing your specific needs and the size of your business. Different software options cater to various business types, from freelancers to large enterprises. Consider factors like transaction volume, reporting requirements, and compliance needs to narrow down the choices.

Another important aspect is user-friendliness. The software should be intuitive enough for your team to adopt quickly without extensive training. Look for solutions that offer a trial period or demo. This allows you to gauge the user experience and functionality firsthand. Additionally, review customer support options to ensure you have access to assistance when needed, which can significantly impact your overall satisfaction with the software.

Lastly, think about scalability. Your chosen accounting software should be able to grow with your business. As you expand, the software should support additional features without requiring a complete overhaul. Evaluate the software’s upgrade options and integrations with other tools you may already use, such as inventory management or payment processing systems. A well-chosen accounting software can streamline your financial processes and contribute significantly to your business's success.